In the growing DeFi panorama, both institutional traders and retail investors are starting to notice the inherent privacy issues with the most popular Layer-1 blockchains.

The extreme transparency of L1s such as Ethereum, Solana, and Avalanche, to name a few, leaves investors vulnerable to attacks such as front-running and MEV. Meanwhile, the lack of interchain features to seize the many opportunities of a thriving ecosystem keeps billions of dollars in value separated. And, of course, traceability and surveillance are issues permanently looming on the horizon.

Introducing Panther Protocol, the Missing Piece in the PriFi Ecosystem

While most of the crypto ecosystem is aware of the privacy pitfalls of otherwise ground-breaking blockchains, Privacy Finance has not yet had its chance to blossom.

This is because many of its proponents offer fragmented, siloed solutions to the privacy vs. trust paradox, hindering their utility and adoption. Privacy coins are generally not programmable or EVM-compatible. Currently available L2 solutions are usually centralized. On-chain mixers are single-use and can’t grow their own ecosystem. Even on-chain L1 solutions have, by nature, single points of failure. Moreover, the privacy ecosystem consisting of several isolated projects yields scant network effects, hindering growth across the board.

Panther protocol aims to solve this by creating a unique system full of synergic products and on-chain services. These include private liquidity and transactions for all crypto assets, an affordable and scalable private interchain DEX, trustless data proofs enabling privacy-preserving data sharing in Web3, and multiple other impactful PriFi solutions.

Users of Panther will be able to wrap any token, in any chain, as a zAsset used to transact privately. For example, 1 zETH would be a 1:1 shielded representation of an Ether, ready to be used across DeFi applications and on multiple chains. Panther is currently building on Ethereum, Polygon, Near, Avalanche, Elrond and Flare.

At the center of Panther protocol’s design is its token, $ZKP, which plays a crucial role in Panther’s vision to infuse DeFi with privacy. $ZKP’s numerous utilities and thoughtful tokenomics founded on game theory are designed to help the token accrue value while the protocol captures TVL. This article explores the need for Panther in PriFi, $ZKP’s potential, and the main factors that can influence Panther’s TVL.

Panther’s Roadmap, in Less Than a Minute

Panther’s go-to-market strategies can be summarized in three stages:

Utilities of the ZKP Token

Some of the behaviors that Panther incentivizes through $ZKP are:

Tokenomics, Inflation, and Distribution

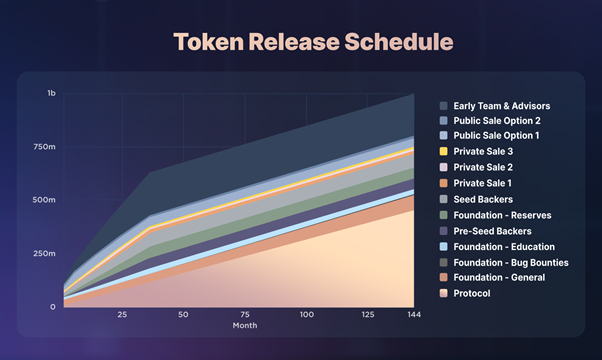

These three charts hold indispensable information around $ZKP’s tokenomics:

Chart #1 – Allocation per stakeholder.

Chart #2 – Token release schedule.

Chart #3 – Key metrics on launch.

Panther’s tokenomics are designed so, with a token price at launch of about $0.40 and 110M $ZKP circulating, Panther’s market cap (MC) will be at a conservative approximate of $41M. The Fully Diluted Value (FDV) will thus be around $400M. The proportion between Market Cap and FDV (or simply MC/FDV ratio) is crucial to understand how valuable the token could become should it quickly accrue TVL.

Panther’s initial 10% MC/FDV ratio is better off the bat than some established names in DeFi. Moreover, the 12-year vesting period assures a smooth gradual release with a limited impact on price, most likely unnoticeable as demand grows exponentially. After 144 months, no more $ZKP tokens will ever be minted, and $ZKP becomes fully deflationary, while TVL drives the perception of the token as valuable.

External and Internal Factors Driving TVL

TVL is one of the most meaningful metrics in DeFi. Having a Total Value Locked higher than a project’s MC can be seen as a catalyst for protocol growth. Given its institutional backing and investors, Panther’s $40 million should be easily reachable. Staking by itself should lock away close to $13M from Day 1, assuming a 30% staking ratio. Attracting more TVL through solid incentives and growing utilities should make a near $2.5 – $6.0 token price rather probable.

There are several factors that could move Panther’s TVL to grow faster than its circulating market cap. Bringing institutional dark pools on-chain, once the protocol has established itself in the retail market, is a vital one. Dark Pools consist of capital institutions pooling assets to trade with each other privately, avoiding moving public prices with their movements. Estimates indicate that these tools represent up to 18% of the trading volumes in the US, while some estimates point to 40% worldwide. If these percentages translate to the whole DeFi ecosystem, Panther could become a zero-knowledge industry TVL black hole.

The blockchain ecosystem also needs an equivalent to cash, whose total value (M1 supply) sits around $15 Trillion. Panther does NOT aim to create decentralized stablecoins but enables shielding existing stablecoins as zAssets. In that way, Panther can help establish a token economy that does not rely on any one party and that connects assets in every blockchain.

Panther protocol is chain-agnostic and bets on a multi-chain future. Its private Interchain DEX will allow Panther to address the whole DeFi market instead of just sections of it. If just 1% of the top 5 chains’ TVL ends locked in Panther either due to $ZKP fees, zAsset wrapping, staking, purchases, etc., this singlehandedly would represent $1 Billion of TVL.

Through ZK Reveals, the final piece of Panther’s master plan, institutions can use Panther to protect themselves on-chain while still disclosing their transaction history at will to whomever they deem necessary. Reveals open the gate for more institutions to participate in the crypto economy. Moreover, as blockchains begin to be utilized for hosting the Metaverse, decentralized social apps, verifying digital identities, etc., built-in privacy features become essential to offset the mishappens of perfect transparency. Therefore, ZK Reveals and private asset transfers can be critical to enabling these systems to protect their users.

Composability in DeFi Is Key

Each of the tools mentioned in this article can be used and leveraged by the entire ecosystem.

Other DeFi projects may compose with Panther-produced primitives to achieve results not described here, some of them even beyond what’s currently possible in DeFi and crypto. In this sense, it is helpful to think of Panther as a general-purpose tool, rather than a privacy hammer, that will strengthen and empower the entire crypto industry.

Panther is building the tools necessary to move as much capital as possible from Traditional to Decentralized Finance… but, some may argue, this is just the beginning.

About Panther Protocol

Panther is an end-to-end privacy protocol connecting blockchains to restore privacy in Web3 and DeFi while providing financial institutions a clear path to compliantly participate in digital asset markets.

Panther provides DeFi users with fully collateralized privacy-enhancing digital assets, leveraging crypto-economic incentives and zkSNARKs technology. Users can mint zero-knowledge zAssets by depositing digital assets from any blockchain into Panther vaults. zAssets flow across blockchains via a privacy-first interchain DEX and a private metastrate. Panther envisions that zAssets will become an ever-expanding asset class for users who want their transactions and strategies the way they should always have been: private.

Stay connected: Telegram | Website

Disclaimer

The information and data contained in this document is provided for information only and should not be taken as investment, legal, financial or other professional advice. Any opinions expressed in the document are the author’s alone, and do not necessarily represent opinions of Panther Protocol or any legal entity associated with that project. Nothing in this document is, or should be considered to be, a financial promotion or other offering or invitation to subscribe for or purchase any asset described or referred to in this document. Information contained in this document is only intended to be current as of its first date of publication and will not necessarily be updated. Any information obtained from third-party or external sources is taken from sources reasonably believed by the author to be accurate, but without providing any assurances as to its accuracy.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Russian Government Drafts Roadmap to Regulate, Not Ban Crypto, Report Unveils

A roadmap on cryptocurrencies has been prepared by a number of ministries, regulatory bodies, and law enforcement agencies, Russian media reported. The document, which aims to regulate Russia’s crypto market by the end of this year, comes amid disagreements between ... read more.

Nenhum comentário:

Postar um comentário